Data Discrepancy: The Truth About Market Movers

Rubrik's Surprise Profit, SoFi's Share Offering: What's the Real Story?

The market's a fickle beast, reacting to headlines with the predictability of a caffeinated squirrel. Take Friday's movements: Rubrik, the cybersecurity outfit, popped over 18% after reporting a surprise profit. SoFi, on the other hand, stumbled 7.6% after announcing a $1.5 billion common stock offering. HPE (Hewlett Packard Enterprise), missed revenue expectations, and the stock price reflected that. Ulta Beauty bucked that trend, rising 5.6% after earnings crushed expectations. But what’s really going on here?

Profit vs. Growth: A False Dichotomy?

Rubrik's surge is the most interesting, frankly because it's unexpected. A cybersecurity company posting a profit these days is like finding a unicorn in your backyard. The company reported adjusted earnings per share of 10 cents, a stark contrast to the anticipated 17-cent loss. That’s a $0.27 swing (to be precise), and the market loves a good surprise. But let's not get carried away. One profitable quarter doesn't erase previous losses or guarantee future success. The question remains: is this a sustainable trend, or a one-off fueled by, say, aggressive cost-cutting that could stifle long-term innovation? We'll need to see at least two more quarters of similar performance before declaring victory. I'm also curious about the quality of that profit. Did they land a whale of a customer, or did they simply slash R&D? The answer to that question dictates whether Rubrik is a flash in the pan or a real contender.

SoFi's Share Offering: Dilution or Necessary Evil?

SoFi's situation is a bit more nuanced. The market hates dilution, plain and simple. Announcing a $1.5 billion share offering is Wall Street code for "we need cash," and that immediately raises questions. SoFi claims it will use the funds for "general corporate purposes, including enhancing its capital position and funding growth." That's corporate speak for, well, anything. While growth is good, at what cost? Are they simply buying growth by offering more and more products and services, or is there real, organic demand? I find the lack of specificity troubling. A more transparent explanation of where that $1.5 billion will be deployed would have softened the blow to the share price.

HPE's Missed Expectations: A Sign of Broader Trouble?

HPE's 9% drop (initially in premarket trading) is concerning, though not entirely surprising. Tech hardware is a tough business, and missing revenue expectations in a sector that's already facing headwinds is a recipe for disaster. Server revenue, a key indicator, fell 5% to $4.46 billion. This isn't just about one quarter; it's about the broader trend. Are companies pulling back on infrastructure spending? Are they shifting to cloud-based solutions at a faster rate than HPE anticipated? The after-hours numbers confirm this, with HPE falling 4% after quarterly revenue trailed estimates ($9.7B versus $9.9B). The disappointing guidance is the real killer here. I wonder if HPE is accurately forecasting the market's shift. Are they clinging to legacy hardware revenue streams while competitors are embracing the future?

Ulta Beauty's Success: A Sustainable Trend?

Ulta Beauty's rise is a welcome counterpoint. The company reported adjusted earnings per share of $5.14, beating Wall Street's consensus of $4.61. People, it seems, will always spend money on looking good, even when the economy is uncertain. Ulta's strong Q3 EPS and revenue, combined with raised guidance, paints a rosy picture. But even here, skepticism is warranted. Is this a sustainable trend, or a temporary boost fueled by pent-up demand after the pandemic? Can Ulta maintain its growth trajectory as competition intensifies and consumer spending eventually cools?

Market Overreactions and Long-Term Trends

The market often overreacts to short-term news, ignoring the underlying fundamentals. Rubrik's one profitable quarter is a positive sign, but it doesn't guarantee future success. SoFi's share offering is a necessary evil for growth, but it dilutes existing shareholders. HPE's missed expectations are a warning sign, but the company could still turn things around. Ulta Beauty's strong performance is encouraging, but the company faces challenges ahead. It's a complex picture, and investors need to look beyond the headlines and focus on the long-term trends.

The Problem with "Analyst Estimates"

I've looked at hundreds of these reports, and I'm always a bit suspicious of the "analyst estimates" that get bandied about. Who are these analysts, and what's their track record? How are these "consensus" estimates calculated? Are they truly independent, or are they influenced by the companies they cover? It's a black box, and I suspect that many of these estimates are simply regurgitated from sell-side research, which has its own biases and incentives. A healthy dose of skepticism is always warranted when dealing with Wall Street forecasts.

The Real Takeaway: Broader Economic Factors

The real story here isn't about individual stock movements; it's about the broader economic landscape. Inflation data is looming, and the Federal Reserve's next interest-rate decision is just around the corner. These are the factors that will ultimately determine the fate of these companies, not just a single quarter's earnings or a share offering. The market is a complex system, and these stock movements are just symptoms of larger forces at play.

Beyond the Numbers: Context and Strategy

Ultimately, the market's reaction to these announcements is a reminder that numbers alone don't tell the whole story. It's important to understand the context, the underlying trends, and the management's strategy. As investors, we need to be critical thinkers, not just headline readers. HPE, Netflix, SoFi, Ru

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

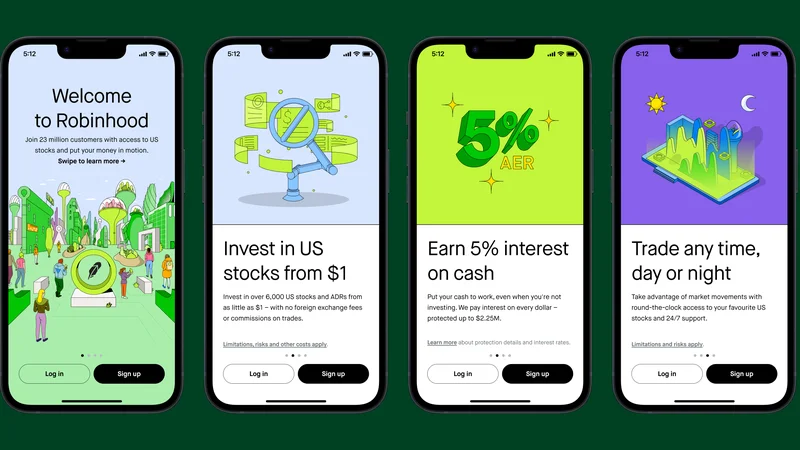

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- DeFi's 'Recovery': It's All a Sham (- Deep Dive!)

- Data Discrepancy: The Truth About Market Movers

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Starknet: What it is, its tokenomics, and current valuation

- The Future of Tax: Decoding Your 2025-2026 Tax Brackets and Preparing for Tomorrow's Financial Landscape

- Dairy Queen Chapter 11: Unlocking the 'jackpot' of its next chapter

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)