✔️ Final Title: SEC Freezes Ultra-Leveraged ETFs: The Hidden Costs (r/Crypto)

Crypto Regulation 2026: Trump's GENIUS Act, Stablecoin Softening, and North Korean Hacks

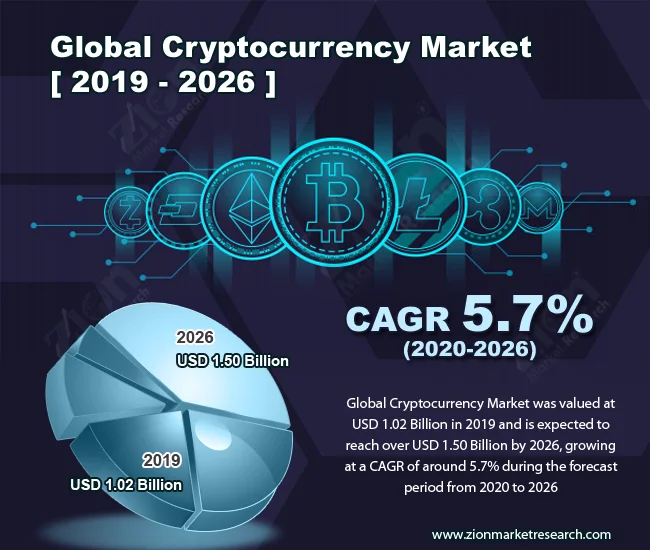

Okay, let’s cut to the chase. TRM Labs dropped their 2025/2026 crypto policy review, and the headline is pretty clear: regulatory clarity, especially around stablecoins, is driving institutional adoption. We're talking about 80% of jurisdictions seeing financial institutions launch digital asset initiatives. (Not all initiatives are created equal, of course; some are just press releases.) But is it really that simple? Or is there something else brewing beneath the surface?

The report emphasizes the US GENIUS Act as a landmark, and points to a general "softening" of regulatory attitudes, especially from the Basel Committee, which is reassessing its capital deduction rules for banks holding crypto. The implication is that crypto is going mainstream, and the suits are finally starting to get it. I am not entirely convinced.

Stablecoin Regulation and Adoption

Stablecoins Take Center Stage… Again

Seventy percent of the jurisdictions reviewed advanced stablecoin regulatory frameworks in 2025, according to TRM Labs. That's a big number. They point to the GENIUS Act in the US, MiCA in the EU, and progress in Hong Kong, Japan, Singapore, and the UAE. The narrative is that stablecoins are becoming "true mediums of exchange" due to their stability.

But let's be real. Stablecoins are only as stable as the assets backing them. And the regulatory focus is precisely because of the inherent risk in those backing assets. Are they really fully reserved? Are the audits legit? Are the redemption mechanisms sound? These are the questions regulators are grappling with, and the answers aren't always reassuring. I’ve seen enough dodgy balance sheets to know that “stable” is a relative term, especially in crypto.

Furthermore, the report highlights the growth of stablecoin use in Brazil, with 90% of crypto asset use linked to stablecoins. But the article also notes that Brazil is considering taxing crypto for cross-border payments to prevent regulatory arbitrage. So, is this a sign of adoption or a sign that regulators are trying to close loopholes? I'd argue it's both, but the latter shouldn't be ignored.

The Shadowy Underbelly of Crypto

The Dark Side: Hacks and Regulatory Arbitrage

The TRM Labs report isn't all sunshine and roses. It highlights North Korea's $1.5 billion hack on Bybit in early 2025, with the stolen Ethereum laundered through unlicensed OTC brokers, cross-chain bridges, and decentralized exchanges. This, they argue, underscores the need for better cross-jurisdictional coordination and real-time information sharing.

Absolutely. But it also highlights a fundamental problem: regulation is only as effective as its weakest link. As FATF warned, "VASPs in jurisdictions with weak or non-existent frameworks" remain vulnerable to exploitation. And guess what? Illicit actors are really good at finding those weak links. The report also mentions that VASPs have significantly lower rates of illicit activity than the overall ecosystem - but that doesn’t eliminate it.

Here's the part of the report that I find genuinely puzzling. The report states that the North Korean hack led to the loss of USD 1.5 billion in Ethereum tokens. But it was laundered through OTC brokers, cross-chain bridges, and DEX's -- infrastructure that largely sits outside existing regulatory perimeters.

The report is implying this single hack should be a call for better cross-jurisdictional coordination. But is it really? Or is it a call for more regulation of DEX's and cross-chain bridges? And if that’s the case, are we sure that's what we want?

Regulatory Shifts and Their True Meaning

Friendlier Attitudes? Or Just a Different Kind of Pressure?

The report claims that 2025 saw the US lead an acceleration in crypto policymaking and "friendlier regulatory attitudes" under the Trump administration. They cite the GENIUS Act and coordinated agency action as evidence.

I'd rephrase that. It's not necessarily "friendlier," but more like a shift in focus. The Trump administration, as the report notes, rejected a retail CBDC and emphasized innovation. This is not the same as embracing crypto with open arms. It's about controlling the narrative and ensuring that the US remains competitive in the digital asset space.

The report also mentions the SEC's Project Crypto, modernizing securities regulation and clarifying when tokens qualify as securities. Again, this isn't necessarily "friendly." It's about bringing crypto within the existing regulatory framework, which could stifle innovation if not done carefully.

Conclusion: A Balanced Perspective on Crypto Regulation

A More Nuanced Take Is Needed

The TRM Labs report paints a picture of increasing regulatory clarity driving institutional adoption and reducing illicit activity. And while there's certainly some truth to that, it's not the whole story. Regulation is a double-edged sword. It can provide legitimacy and attract institutional investment, but it can also stifle innovation and drive illicit activity to less regulated corners of the globe.

The key, as always, is balance. But finding that balance requires a more nuanced understanding of the risks and benefits of crypto, and a willingness to adapt regulations as the technology evolves. And that's something that governments around the world are still struggling with.

Regulatory Theatre

The numbers are interesting, sure. But regulation is, at its core, political. And politics is about power, not necessarily about making the smartest decisions. It's easy to point to institutional adoption as a sign of progress, but it's also important to ask: who benefits from this adoption? Is it the average retail investor, or is it the big banks and hedge funds that are now getting into the game? And are we sure that these new regulations are actually preventing illicit activity, or are they just pushing it to new, harder-to-reach places? These are the questions that keep me up at night.

-

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

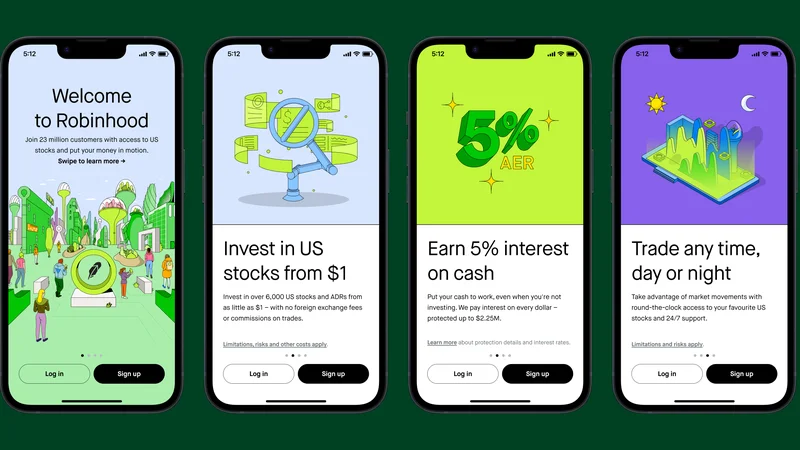

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- ✔️ Final Title: SEC Freezes Ultra-Leveraged ETFs: The Hidden Costs (r/Crypto)

- DeFi's 'Recovery': It's All a Sham (- Deep Dive!)

- Data Discrepancy: The Truth About Market Movers

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Starknet: What it is, its tokenomics, and current valuation

- The Future of Tax: Decoding Your 2025-2026 Tax Brackets and Preparing for Tomorrow's Financial Landscape

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)